November 5, 2025 – Montreal, Quebec – Mosaic Minerals Corporation (CSE: MOC) (“Mosaic” or the “Company”) announces that it has signed a letter of intent (“the Transaction”) with a group of prospectors (“the Prospectors”) to acquire 100% of Golden Island project (Île D’Or) (“the Property”). The Property, with a rich history of mining exploration dating back nearly a century, consists of 31 contiguous claims located in Tiblemont Township, NTS map sheet 32C06, near Senneterre in Abitibi-Témiscamingue, Quebec.

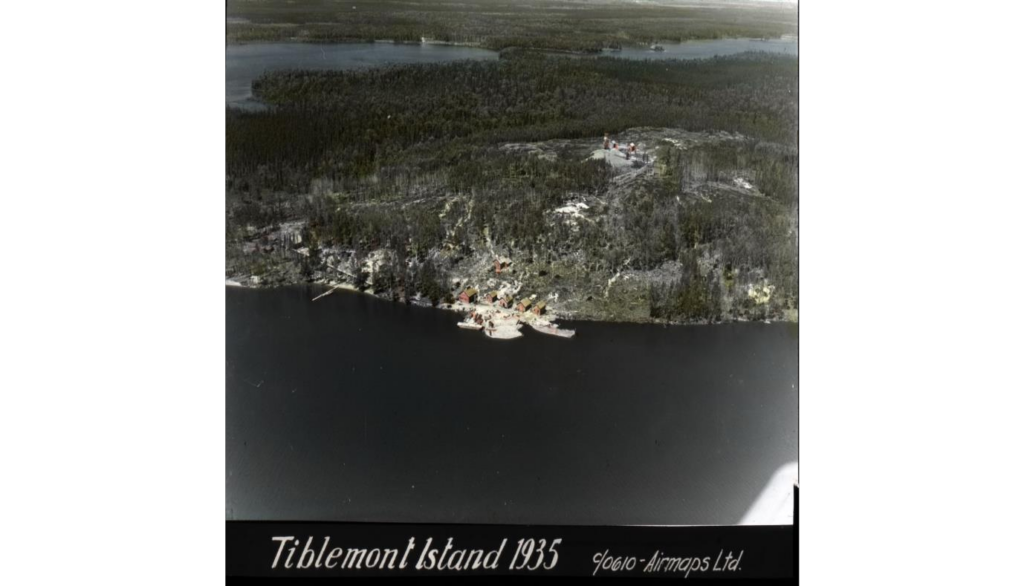

The Golden Island project is accessible year-round via Regional Road 113, which connects the towns of Val-d’Or and Senneterre. The property is located on Tiblemont Island (see map) and is accessible by boat from the Tiblemont Lake boat launch just before the town of Senneterre. The site contains the remains of the former Tiblemont Island gold mine. This mine was discovered in the early 1930s but never reached commercial production.

Historical Work and Resources

Extensive work was undertaken following the discovery of the property, then known as “Mining Concession 282,” in 1932 by Dr. Theodore Koulomzine, a renowned geologist/geophysicist, until its abrupt abandonment at the outbreak of World War II in 1939. During this period, Tiblemont Consolidated built a camp with multiple permanent buildings, all of which are now gone. Nearly 3,350 linear meters of trenches were dug, as well as a three-compartment vertical shaft sunk to a depth of 155 meters. A 360-meter-long adit was also driven into the hillside at lake level, subsequently connected to the shaft at the 100-meter level. Underground development extends to 1,800 meters at the 360 and 485-meter levels. A 5-ton mill was also in operation. Documents from that time indicate several gold-bearing zones located near the surface that could be mined using open-pit methods. A resource estimate, not compliant with Regulation 43-101, indicates 391,000 tons at a grade of approximately 2.8 g/t at a depth of just under 60 meters (GM41028). Multiple exploration programs have been carried out in previous years. Notably, in 1982, SOQUEM completed a short program of 8 drill holes (1,150 meters), three of which were drilled in the main zone. (See Table 1)

The resource estimates described in this document are considered historical resources and do not comply with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Company does not consider the historical estimate to be a current mineral resource and does not assert that any or all of the mineralization described will be subsequently converted into mineral resources or mineral reserves defined in accordance with National Instrument 43-101.

Table 1 – Drilling Results – SOQUEM 1982 (GM38876)

| Drill hole | From (m) | To (m) | Length (m) | Grade (g/t Au) | Zone |

| 82-2 | 63,5 | 81,2 | 17,7 | 1,18 | Main |

| Including | 75,6 | 81,2 | 5,6 | 2,99 | |

| And | 111,18 | 137,10 | 25,9 | 1,42 | |

| Including | 111,18 | 123,50 | 11,7 | 2,09 | |

| 82-6 | 56,1 | 70,5 | 14,4 | 1,25 | Main |

| Including | 56,1 | 61,3 | 5,2 | 2,01 | |

| 67,6 | 70,5 | 2,9 | 2,97 | ||

| 82-8 | 40,4 | 53,5 | 13,1 | 1,49 | Main |

| Including | 46,8 | 51,9 | 5,1 | 2,39 |

It should also be noted that drill hole 82-5, located approximately 1 km northwest of the main zone, intersected a 4.7-meter interval grading 1.31 g/t Au. This drill hole is associated with the same magnetic anomaly as the one linked to the main shaft.

2024 Exploration Campaign

An exploration session using an underwater drone allowed for the clear photographic identification of quartz veins and veinlets in the gallery walls. The strength of the rock has prevented the gallery from collapsing, even after nearly a century. Sampling work carried out in the fall of 2024, supervised by Mr. Jean Gagnon, geologist, focused on a series of gold-bearing veins located southeast of the old mining shaft. A total of 25 selected samples were collected (see Table 2), both from the old trenches and from outcrops.

During the 2024 sampling, the presence of numerous quartz veins was noted in the area surrounding the trenches and the former main shaft. Further fieldwork will be necessary to map and sample all of these veins, which appear to form a gold-bearing corridor several tens of meters wide. The gold-bearing zone is in contact with a high-amplitude magnetic anomaly several kilometers long trending in a northwest-southeast direction.

Table 2 – Best Samples Results (Fall 2024)

| Samples | Description | UTM E | UTM N | g/t Au | |

| O0292983 | Outcrop of granodiorite with a quartz vein | 329610 | 5348025 | 4,58 | |

| O0292984 | Outcrop of granodiorite with a quartz vein | 329622 | 5348018 | 3,89 | |

| O0292988 | Zone T, Old N-S trench, greenish coating possibly malachite, cubic PY, | 329625 | 5347992 | 7,50 | |

| O0292991 | Former trench, E-W contact zone, Vn QZ and granodiorite, tr CPY, coarse PY. | 329632 | 5348009 | 101,19 | |

| O0292993 | Outcrop of granodiorite, presence of a vertical vein, outcrop that has never been broken. | 329628 | 5348043 | 17,94 | |

| O0292994 | Occurrence of granodiorite (never broken), Vn QZ tension, vertical, small gold grains in AK, approximately 17 g/t. | 329627 | 5348042 | 56,69 | |

| O0292998 | Granodiorite with quartz vein, trace of pyrite, drilling area of zone Z. | 329834 | 5348245 | 96,13 | |

| O0293000 | Resampling of the block area containing sample O0292985 | 329627 | 5348020 | 55,31 |

Terms of the Agreement

Under the Transaction, the Company has the option to acquire up to 100% of the Property on the following terms:

Date Cash Shares Warrants Interest

Signature $150,000 5,000,000 2,500,000* 25%

2027 $125,000 $300,000** 50%

2029 $125,000 $300,000** 75%

2031 $125,000 $300,000** 100%

Total : $525,000 $1,150,000 2,500,000

* Warrants exercisable at $0.10 for 24 months

** 15-day VWAP of Mosaic’s share price

Mosaic also agrees to pay an ounce-based bonus upon filing a resource estimate compliant with NI 43-101 standards with a minimum grade of 1.4 g/t Au and a cut-off grade of 0.3 g/t Au.

- A payment of $1.20 per ounce up to 250,000 ounces ($300,000)

- $300,000 in Mosaic shares (15-day VWAP)

- $300,000 in Mosaic shares (15-day VWAP)

- A payment of $0.75 per ounce from 250,001 to 500,000 ounces ($487,500 including the $300,000 mentioned above).

- $600,000 in shares (15-day VWAP) including the shares mentioned in A)

- $600,000 in shares (15-day VWAP) including the shares mentioned in A)

- A payment of $0.50 per ounce from 500,001 ounces onwards (no maximum)

- $1 million in shares (15-day VWAP).

The prospectors will hold a 1% NSR royalty on all mining claims. Globex Mining Enterprise holds a 1% GMR on 5 claims and a 2% GMR on 12 claims. 50% of the royalty on these latter 12 claims (1%) is redeemable for the sum of $600,000.

Mosaic may accelerate the exercise of the option at any time and will be the manager of the work.

Qualified Person

The scientific and technical information of Mosaic Minerals Corporation included in this press release has been reviewed and approved by Gilles Laverdière, P.Geo, Vice-President Exploration of Mosaic Minerals and qualified person under National Instrument 43-101 respecting information concerning mining projects (“Regulation 43-101”).

This release contains certain “forward-looking information” under applicable Canadian securities laws concerning the Arrangement. Forward-looking information reflects the Company’s current internal expectations or beliefs and is based on information currently available to the Company. In some cases, forward-looking information can be identified by terminology such as “may”, “will”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “projects”, “potential”, “scheduled”, “forecast”, “budget” or the negative of those terms or other comparable terminology. Assumptions upon which such forward-looking information is based includes, among others, that the conditions to closing of the Arrangement will be satisfied and that the Arrangement will be completed on the terms set out in the definitive agreement. Many of these assumptions are based on factors and events that are not within the control of the Company, and there is no assurance they will prove to be correct or accurate. Risk factors that could cause actual results to differ materially from those predicted herein include, without limitation: that the remaining conditions to the Arrangement will not be satisfied; that the business prospects and opportunities of the Company will not proceed as anticipated; changes in the global prices for gold or certain other commodities (such as diesel, aluminum and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, financing and interest rates; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals. The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.