MONTREAL, March 22, 2022 (GLOBE NEWSWIRE) — Mosaic Minerals Corporation (CSE: MOC) (“Mosaic” or the “the Corporation”) adds 19 claims covering an area of 791 hectares on the western edge of its Gaboury property, located in Quebec’s Témiscamingue region. This project is now composed of 114 claims for a total area of 6,064 hectares. Thirteen of these new claims were acquired by map staking while the other six were acquired from an independent prospector, in return for a cash payment of $10,000.

No royalty is subject to these new claims.

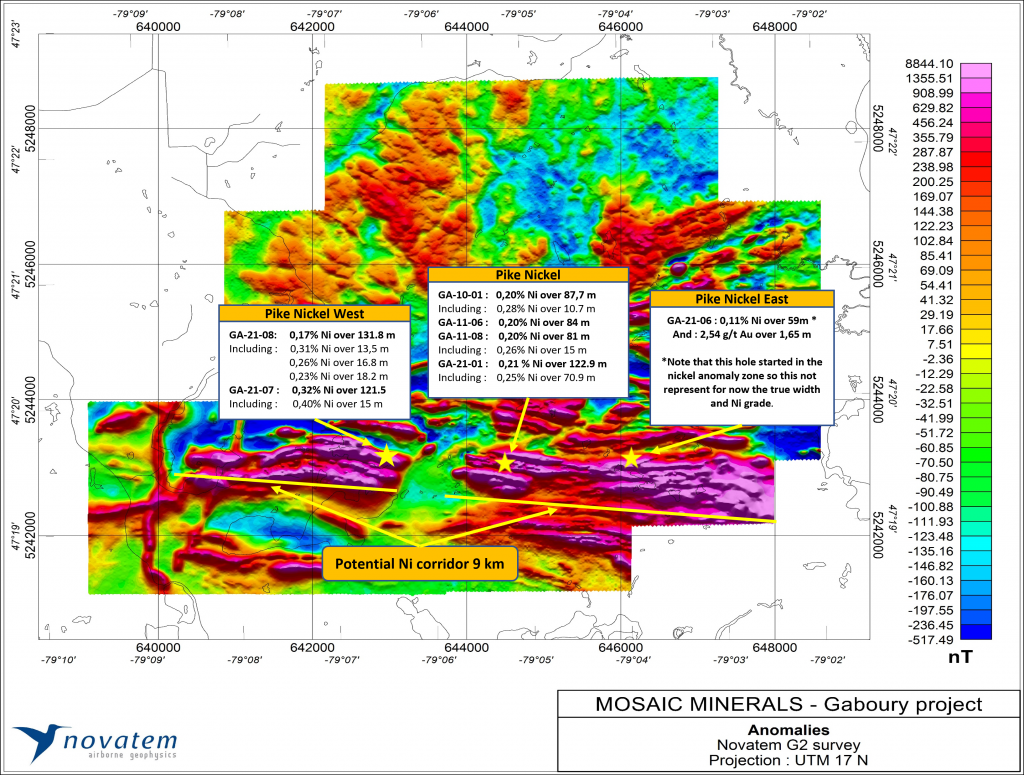

The Gaboury property contains several nickel, copper, and gold showings. However, the management of the Company is concentrating its activities on the search for nickel along a magnetic anomaly crossing it for nearly 9 km, in its southern part. The presence of a mineralized ultramafic intrusive explains that magnetic anomaly.

Pike Nickel

The Pike Nickel showing, discovered by drilling in 2010, was drilled again in 2021 to test its potential for lateral and depth extension. That program made it possible to retrace the Pike Nickel West and Pike Nickel East extensions located on each side at 1.8 km and 1.4 km from the original showing as well as to intersect it to a vertical depth of nearly 400 meters. These showings remain open both laterally and at depth.

The southern part of the property now contains three significant nickel showings over nearly 3.4 km along a magnetic anomaly of about 9 km. Depending on its financial capacity, the company’s management hopes to test the entire magnetic anomaly by drilling during 2022. A first phase of drilling concentrated in the western part of the magnetic anomaly is planned at the end of the spring thaw period.

“The current geopolitical situation with Russia, which is one of the main producers of refined nickel, demonstrates the importance of projects such as Gaboury located in Quebec. While we want a quick resolution to this terrible conflict, upward pressure on the price of nickel could extend beyond it and potentially affect the value of projects located in stable and predictable mining jurisdictions like Quebec.” Said Jonathan Hamel, President and CEO of the Corporation.

A grade of up to 0.32% Ni over 121.5m along the core including 0.40% Ni over 15m had been intersected in hole GA-21-07 and that hole GA-21-01 had retraced the nickel zone up to 564 meters along core revealing 122m grading 0.21% Ni including 70.9m grading 0.25% Ni (see press release dated January 5, 2022).

In addition, the firm Novatem recently completed a helicopter-borne magnetic survey on the new claims. This will allow the company to define the full drilling program for the current year.

An additional drilling permit application has been filed with the MERN.

Gaboury Project

The Gaboury project, consisting of 114 mining claims totaling 6,064 hectares, is located approximately 150 km southwest of the Rouyn-Noranda mining camp. It is easily accessible year-round by paved and gravel roads. The former Loraine Mine, which produced 600,000 tons of ore grading 0.47% Ni and 1.08% Cu, is located about ten km east of the property (Source: SIGEOM GM 43679). The Loraine deposit consisted of Ni-Cu dominant magmatic mineralization associated with mafic and ultramafic intrusions.

Mosaic has the option to acquire a 60% interest in this project by June 2024 in return for 3M shares and $1M in exploration work. Subsequently, Mosaic may acquire another portion of 20% interest for a total of 80% in consideration of $2.5M in exploration work before June 30, 2028, and the delivery of a first resource estimate. If Mosaic decides not to exercise the second part of its option, the partners will then form a joint venture and Fokus will manage the exploration work.

Nickel Showings

In 2010-2011, Fieldex Exploration now Fokus Mining Corporation drilled the Gaboury property, to test a Maxmin electromagnetic anomaly, which intersected significant nickel grades. The semi-massive sulphide mineralization intersected is hosted in a calcite matrix within fractures in a silicified gabbro. The best results are:

| Hole* | From (m) | To (m) | Length (m) | Ni (%) |

| GA-10-01 | 36,80 | 124,50 | 87,70 | 0,20 |

| including | 36,80 | 46,45 | 9,65 | 0,28 |

| including | 72,82 | 83,50 | 10,68 | 0,28 |

| GA-10-02 | 117,00 | 132,00 | 15,00 | 0,20 |

| including | 151,29 | 168,00 | 16,71 | 0,20 |

| GA-11-06 | 190,50 | 274,50 | 84,00 | 0,20 |

| GA-11-08 | 313,50 | 394,90 | 81,40 | 0,20 |

| including | 364,50 | 379,50 | 15,00 | 0,26 |

*Source: SIGEOM GM 66699

Copper Showings

Also present on the Gaboury property is the Pyke copper showing which is located northeast of the nickel showing. Reported Cu results range from 0.99% to 12.30% Cu in surficial chalcopyrite veins at contact with sheared andesitic volcanic rock. Semi-massive mineralization consists of chalcopyrite, pyrite and pyrrhotite in a matrix of calcite. Limited drilling of some electromagnetic conductors did not yield significant copper results. Mosaic management will reassess this area shortly to develop a better understanding of this surface copper showing.

Gold Showings

Within the Gaboury property, the Laverlochère and Brisebois gold occurrences have returned historical gold grades of up to 445 g/t Au in quartz veins ranging from 0.3 to 5 m thick, while another mineralized shear zone ranging in thickness from 2 m to 25 m gave gold grades of up to 8.8 g/t Au. Gold grades of 27.97 g/t Au and 9.51 g/t Au over 0.20 m were intersected in hole G-18 on the Brisebois showing, while selected samples returned grades of 0.71 g/t Au and 1.23 g/t Au. Copper results have also been reported in historical work near these showings.

A new gold showing was also traced in hole GA-21-06, revealing a grade of 2.54 g/t Au over 1.65 m including 4.62 g/t Au over 0.8 m. This showing is located south of the nickel zone.¸

The technical content of this press release has been reviewed and approved by Mr. Gilles Laverdière, P.Geo., an independent consulting geologist and a Qualified Person as defined in NI 43-101.

About Mosaic Minerals Corporation

Mosaic Minerals Corp. is a Canadian mineral exploration company listed on the Canadian Securities Exchange (CSE: MOC) now focusing on the exploration for future strategic Copper, Nickel and Zinc deposits in priority on the Quebec Province territory which have a long and successful history of base metal production principally in the Rouyn-Noranda, Matagami, Val-d’Or and Chibougamau mining camps.

This release contains certain “forward-looking information” under applicable Canadian securities laws concerning the Arrangement. Forward-looking information reflects the Company’s current internal expectations or beliefs and is based on information currently available to the Company. In some cases, forward-looking information can be identified by terminology such as “may”, “will”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “projects”, “potential”, “scheduled”, “forecast”, “budget” or the negative of those terms or other comparable terminology. Assumptions upon which such forward-looking information is based includes, among others, that the conditions to closing of the Arrangement will be satisfied and that the Arrangement will be completed on the terms set out in the definitive agreement. Many of these assumptions are based on factors and events that are not within the control of the Company, and there is no assurance they will prove to be correct or accurate. Risk factors that could cause actual results to differ materially from those predicted herein include, without limitation: that the remaining conditions to the Arrangement will not be satisfied; that the business prospects and opportunities of the Company will not proceed as anticipated; changes in the global prices for gold or certain other commodities (such as diesel, aluminum and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, financing and interest rates; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals. The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.