MONTREAL, July 05, 2022 (GLOBE NEWSWIRE) — Mosaic Minerals Corporation (CSE: MOC) (“Mosaic” or “The Company”) announces that it has signed an agreement to acquire 100% of the interest in the Gaboury project (Témiscamingue, Québec) and 113 North project (Abitibi, Québec) from Fokus Mining Corporation (TSX-V: FKM).

Terms of the Agreement

To acquire 100% interest in the Gaboury and 113 North projects, Mosaic will issue 5,000,000 common shares of the Company to Fokus Mining Corporation. The latter will also retain a 2% net smelter royalty on both properties. Following the transaction, Fokus Mining Corporation will own 10 million shares or about 16% of the Company. Upon closing of this transaction, the commitments required in the original agreements become obsolete and void.

Original Option Agreements

In June 2021 (see the press release), Mosaic signed an option agreement with Fokus Mining Corporation to acquire up to 50% interest in the 113 North project :

- Issuance of 2M shares to Fokus Mining Corporation

- Investment of $500,000 in exploration expenditure in the following 4 years

- Formation of a Joint Venture when Mosaic will be vested 50%

In May 2021 (see the press release), Mosaic signed an option agreement with Fokus Mining Corporation to acquire up to 80% interest in the Gaboury project :

The agreement was structured in 2 tranches:

To acquire 60% interest

- Issuance of 3M shares to Fokus Mining Corporation

- $150,000 in exploration expenditures within 12 months

- $850,000 in exploration expenditures within 36 months

To acquire 80% interest

- $500,000 in exploration expenditures per year for the next five years until June 2029

- Complete a NI 43-101 Resource Estimate Report including indicated resources.

“We are very pleased to make this acquisition. The complete ownership of these two projects positions us advantageously for the future. We intend to become a key player in the base metals exploration sector in Quebec,” Said Jonathan Hamel, Mosaic Minerals President and CEO.

The transaction is subject to regulatory approval, including that of the Canadian Securities Exchange. The closing of the transaction is expected to occur on or about July 15, 2022.

Gaboury Project

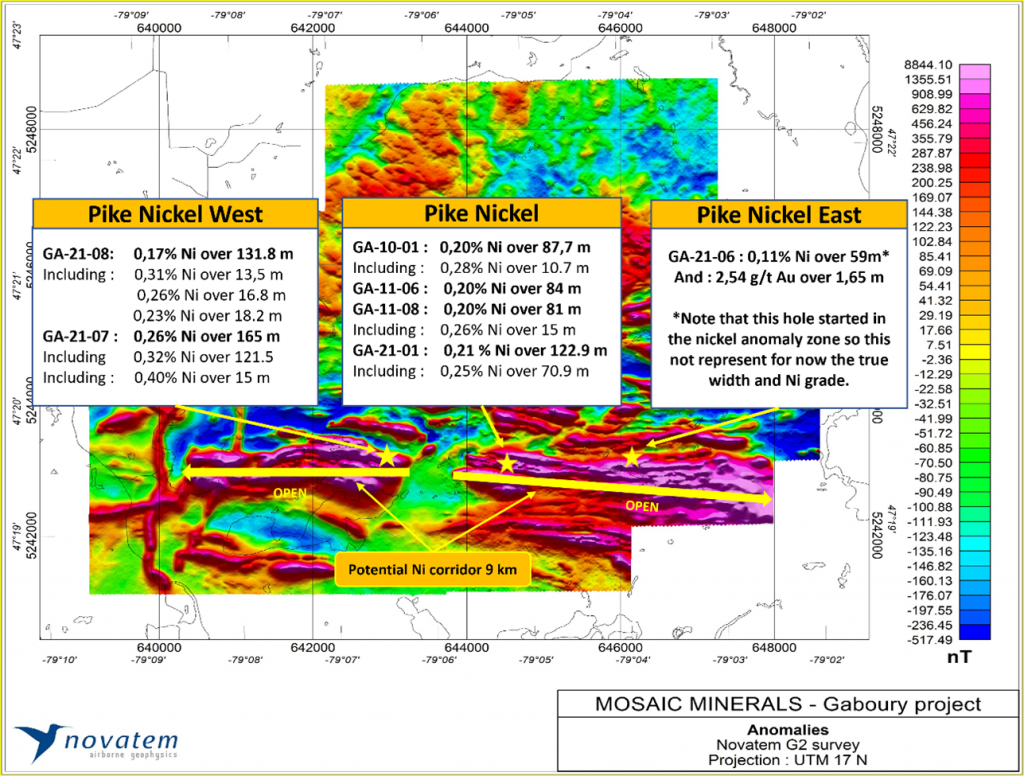

The Gaboury project, comprising 95 claims covering an area of approximately 6,064 hectares, is accessible year-round by a provincial road network and a series of forest roads. In 2010-2011, Fieldex Explorations (now Fokus Mining Corp.) drilled the Gaboury property to test a Max-Min electromagnetic anomaly and intersected significant nickel grades over good widths. The mineralization intersected is located in a wide band of mafic to ultramafic rocks. Grades of 0.20% Ni were intersected over thicknesses varying from 81m to 88m in three holes forming the original Pike Nickel showing.

Following its first drilling campaign in Q4 2021, The Company intersected (see press release dated January 5, 2022) in hole GA-21-07 a 165 m zone showing a grade of 0.26% Ni including 121.5 m at a grade of 0.32% Ni and 0.40% Ni over 15 meters. Hole GA-21-07, located in the Pike West area, is located approximately 1.8 km west of the original Pike Nickel area. Hole GA-21-08 located 300m to the west revealed three sections of 13.5 m, 16.8 m and 18.2 m grading respectively 0.31% Ni, 0.26% Ni and 0.23% Ni in a nickel-bearing envelope 131.8 m at a grade of 0.17% Ni.

As for hole GA-21-01, carried out under historic hole GA-11-08 to verify its potential at depth, revealed a grade of 0.21% Ni over 122.9 m including 70,9 m at a grade of 0.25% Ni. These results confirm a potential for in-depth extension. Hole GA-11-08, completed in 2011, returned 0.20% Ni over 81 m. Hole GA-21-06, located in the Pike East area approximately 1.4 km east of the historic Pike Center area, also reveals an anomalous nickel presence over more than 50 meters. As this hole started directly in the nickel anomaly, this result may not correspond to the actual thickness and grade of the zone there. This same hole, however, intersected a previously unknown gold zone revealing a grade of 2.54 g / t Au over 1.65 m including 4.62 g / t Au over 0.8 meter. The gold occurs in a strongly magnetic, highly silicified iron formation with the presence of chalcopyrite. The company also plans to verify the gold potential of the eastern sector.

The company realized a second phase of drilling in Q2 2022 targeting western extension of the Pike Nickel Zone. Results are expected in the coming weeks. The potential length of the nickel-bearing zone is now 9 kilometers across the property.

113 North Project

The 113 North project is located in the southeastern part of the Abitibi greenstone belt and is comprised of 59 claims totaling 3010 ha within a 6-to12-kilometer-wide band made up of volcano-sedimentary rocks located between the granodiorite-tonalite batholiths of Josselin and Montgay. The volcanic rocks of this group exhibit felsic, intermediate, and mafic compositions and are intersected by dunnite, gabbro and diorite dykes. Iron formations (sulfides and oxides) and clastic sedimentary rocks, such as greywackes and shales, are also present.

Gold, copper, nickel, platinum, and palladium showings were discovered in this geological environment near the project. The company plans to carry out a diamond drilling program of approximately 1,200 m this year.

The technical content of this press release has been reviewed and approved by Mr. Gilles Laverdière, P.Geo., an independent consulting geologist and a Qualified Person as defined in NI 43-101.

About Mosaic Minerals Corporation

Mosaic Minerals Corp. is a Canadian mining exploration company listed on the Canadian Securities Exchange (CSE: MOC) focusing on the exploration of strategic minerals in the territory of the province of Quebec.

This release contains certain “forward-looking information” under applicable Canadian securities laws concerning the Arrangement. Forward-looking information reflects the Company’s current internal expectations or beliefs and is based on information currently available to the Company. In some cases, forward-looking information can be identified by terminology such as “may”, “will”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “projects”, “potential”, “scheduled”, “forecast”, “budget” or the negative of those terms or other comparable terminology. Assumptions upon which such forward-looking information is based includes, among others, that the conditions to closing of the Arrangement will be satisfied and that the Arrangement will be completed on the terms set out in the definitive agreement. Many of these assumptions are based on factors and events that are not within the control of the Company, and there is no assurance they will prove to be correct or accurate. Risk factors that could cause actual results to differ materially from those predicted herein include, without limitation: that the remaining conditions to the Arrangement will not be satisfied; that the business prospects and opportunities of the Company will not proceed as anticipated; changes in the global prices for gold or certain other commodities (such as diesel, aluminum and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, financing and interest rates; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals. The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.